2020年7月23日English

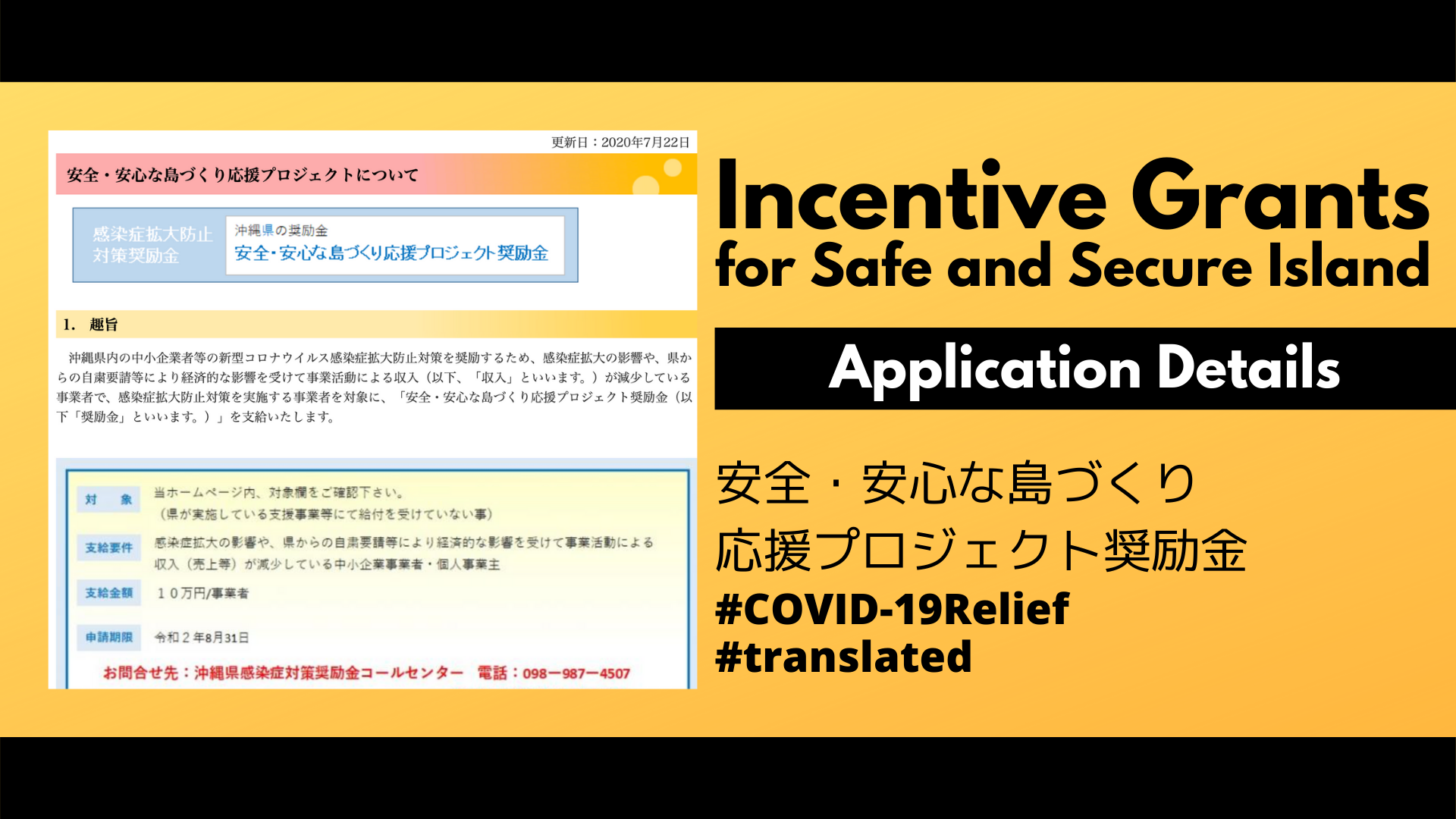

【English Translation:Incentive Grants for Safe and Secure Island】安全・安心な島づくり応援プロジェクト奨励金【COVID-19 Relief】

NEW INCENTIVE GRANT FOR BUSINESSES

Starting from July 17, the Prefectural Government of Okinawa released a new incentive grant called “Incentive Fund for the Project to Support the Development of Safe and Secure Islands (安全・安心な島づく り応援プロジェクト奨励金)”

100,000yen for Businesses who have not received any monetary support

Every business owner who have not received any grants/subsidy from Okinawa Prefectural Government will be eligible to receive 100,000yen.

English Translation for Application Details

Below is the English translation of the detail of the incentive grant. You can find the original Japanese document here.

I. Summary of Incentive Grants

■Purpose

The “Incentive Fund for the Project to Support the Development of Safe and Secure Islands” (hereinafter referred to as “Incentive Fund”) will be provided to businesses that have experienced a decrease in income from their business activities (hereinafter referred to as “Income”) due to the impact of the spread of infectious diseases or the request for voluntary restraint from the prefecture, etc. and are implementing measures to prevent the spread of infectious diseases. The incentive money is provided to businesses that are implementing measures to prevent the spread of infectious diseases.

■Who is Eligible?

Businesses that have already received the grants (1) to (3) below, as well as those that will receive the grants (4) to (9) below, are NOT eligible for this program.

Also, businesses judged by the governor of Okinawa to be inappropriate for the purpose of this project may not be eligible for the subsidy.

(1)新型コロナウイルス感染症防止対策緊急支援事業: Project to urgently support measures to prevent novel coronavirus infection (restaurants that received the subsidy)

(2)新型コロナウイルス感染症防止対策支援事業:Project to support measures to prevent novel coronavirus infection (retailers that received the subsidy, non-store travel agencies, and unaccredited nursery schools).

(3) 新型コロナウイルス感染症拡大防止協力金: Cooperative funds to prevent the spread of the new coronavirus infection (company receiving the cooperative funds)

(4)沖縄県公共交通安全・安心確保支援事業: Okinawa Prefecture public transportation safety and security support project (corporate taxis excluding welfare transport-only taxis and remote island bus routes)

(5)地域医療機関等の新型コロナ感染拡大防止等支援事業: Projects to support local medical institutions in preventing the spread of new corona infections (hospitals, clinics, pharmacies, midwifery centers, visiting nurses)

(6)新型コロナウイルス感染症対策事業(介護・高齢者福祉): Project for countermeasures against new coronavirus infection (nursing care and elderly)

(7)新型コロナウイルス感染症対策事業(障害福祉): Project for countermeasures against new coronavirus infection (welfare for the disabled)

(8)地域福祉推進事業: Project for promoting community welfare (nursing care worker training facilities)

(9)児童福祉施設指導育成費: Guidance and development expenses for child welfare facilities (children’s homes)

*You cannot receive the benefit at the same time as the above-mentioned businesses.

*The type of business will be determined as of April 1, 2020.

■Application Period

From Thursday, July 16th to Monday, August 31st, 2020

*Effective date of postmark is Monday, August 31st.

Grant amount

100,000 yen per business

II. Application Requirements

The Applicant must be a person who meets all of the following requirements (hereinafter referred to as “Applicant”)

1. Small or medium-sized business owners and sole proprietors who have their principal place of business or subordinate offices in Okinawa Prefecture, and who fall under the scope of criteria described in section I.

2. The company intends to continue the business and is willing to provide the “guideline for prevention of the spread of new coronavirus infection” as required by Okinawa Prefecture.

3. A business that commenced operations before April 1, 2020 and whose income had decreased in either of the following situations.

A) Those who has been in business for more than one year

Your income has decreased in any month compared to the same month last year between February 2020 and May 2020.

B) Those who have been in business for less than one year

Businesses whose income in April or May 2020 is lower than in the preceding months.

4. No representative, officer, employee or other employee of the applicant is a gangster as defined in Article 2, item 1 of the Okinawa Prefecture Gang Exclusion Ordinance, or a gangster as defined in item 2 of the same article, and will continue to be so in the future. In addition, the applicant must not fall under this category.

III Application procedures

1. How to obtain and submit the necessary documents to apply for the incentive grant (online or by post)

(1) Online submission

You can submit the application through the Okinawa Prefecture electronic application system.

(Other documents related to the application can also be submitted with a file attachment.)

(URL) https://s-kantan.jp/pref-okinawa-u/offer/offerList_detail.action?tempString=2020syoureikin

We will begin accepting electronic applications at 9:00 a.m. on Thursday, July 16.

Please complete your submission by 11:59pm on Monday, August 31.

*Private taxi operators will only receive applications by mail. (Mailing address 2)

(2) Submission by mail

(a) Obtain the application form and forms from Okinawa Prefecture website

You can download the file from the following page

(URL) https://www.pref.okinawa.jp/site/bunka-sports/kankoshinko/anshin_anzen_project.html

(b) From other related organizations of Okinawa Prefecture

It will be available from 9:00 a.m. on Thursday, July 16 at the following organizations (listed below).

(This service is not available on Saturdays, Sundays, and holidays.)

*In order to prevent the spread of infectious diseases, face-to-face reception and explanation is not available.

If you have any questions, please call the Okinawa Prefectural Incentive Fund for Infectious Diseases Call Center (098-987-4507).

- Okinawa Prefectural Office (1st Floor Kenmin Hall)

- Okinawa Northern Union Building (1st floor, Nago Prefectural Taxation Office)

- Okinawa Central Union Building (1st floor, entrance to Koza Prefectural Taxation Office)

- Okinawa Miyako Joint Government Office (2nd floor, entrance to General Affairs Division)

- Okinawa Prefecture Yaeyama City Hall (Entrance of the General Affairs Division on the 2nd floor)

How to submit the application form

You may submit your application to the following mailing address The application must be postmarked by Monday, August 31. We recommend that you use a method that allows you to keep track of your mail, such as registered mail.

(Mailing Address 1)

Okinawa Prefectural Incentive Money for Infectious Disease Incentive Fund Office, 1st Floor,

3-2-6 Tsubokawa, Naha City, Okinawa 900-0025, Japan

*Please attach a stamp and write the name and address of the sender on the back of the envelope.

*If you are a private taxi business, please be sure to send your application to the following address

(Mailing Address 2 *For Individual taxi owners)

7F, 1-2-2 Izumizaki, Naha City, Okinawa 900-8570, Japan

Required Documents

The required documents are different for corporations and sole proprietorships, so make sure to check them carefully to avoid making a mistake.

In addition, submit enlarged or reduced-size copies of the necessary documents in A4 size, or A3 size if the text cannot be identified.

We may ask for additional materials and explanations if necessary.

The application documents will not be returned.

*If you are submitting online, please download Attachment Form 1, Attachment Form 2-1, Attachment Form 2-2, or Attachment Form 3 from the Okinawa electronic application system, attach the necessary documents and fill in the necessary information, and then scan or photograph each sheet and send it to us.

[For Corporations]

Please submit the following (1) to (4) documents.

(1)Application for Incentive Money and Request for Bank Account Transfer (Form 1) for the Project to Support Safe and Secure Island Development

(2)A copy of the front and back of the account book (Form 1 attached)

The part where you can check the account number and the name of the owner.

(3)Copy of identification documents (Form 2-1)

1 Copy of photo identification of the representative of the corporation

(Driver’s License, My Number Card (back side not required), Basic Resident Register Card (back side not required), Residence Card, etc.)

(4) Documents confirming a decrease in income

* Any of the following 1, 2, 3, or 4

(1) Those who in business over one year or more

1. Any month during the period from February 2020 to May 2020 in which income has decreased compared to the same month last year

The following documents confirming the amount of income for the current and previous year’s corresponding months

a. Income of the current year (the month in which income decreases): Copies of the book that can confirm the amount of income (any form is acceptable).

b. Income of the previous year (the month in which income is compared): Documents related to the most recent income tax return

(a)Copy of Appended Table 1 of the income tax return

(b)Copies of two copies of the statement of corporation’s business conditions (front and back) or copies of the book that can confirm the amount of income by month.

If you do not have a copy of your tax return, please submit a copy of your tax return that you read on the tax return inspection service at the tax office. A picture of the calligraphy is acceptable.

(2) Those who have been in business for less than one year

(a) A copy of the book in which the income of April or May 2020 has decreased from the previous months, and in which the amount of income can be confirmed (any form is acceptable)

(b) A certified copy of the commercial/corporate registry (certificate of current status or certificate of total historical records issued within the last 3 months) or a copy of the screen that shows the corporate number on the corporate number public website (National Tax Agency)

(3) Copies of Notice of Benefit Determination for Sustainment Benefits

(4)Safety Net Guarantee 4 or 5 under Article 2.5 of the SME Credit Insurance Act; or A copy of the certificate received from the mayor of the municipality regarding the application of the crisis-related guarantee under Article 2, paragraph 6 of the same law.

[For Individuals]

Please submit the following (1) to (4).

(1)Application for Incentive Money for the Project to Support Safe and Secure Island Development and Request for Account Transfer (Form 1)

(2)Copies of the front and back of the bankbook (Form 1)

The part where the account number and the name of the holder can be verified

(3)Copies of identification documents (Form 2-1 and 2-2)

Submit both 1 and 2 below

1. Copy of a photo ID(Driver’s License, My Number Card (back side not required), Basic Resident Register Card (back side not required), Residence Card, etc.)

2. Copy of health insurance card

(Necessary to determine if you are an employee.)

(4) Documents confirming a decrease in income * Any of the following 1, 2, 3, or 4

1 In the case of business experience of more than 1 year Any month during the period from February 2020 to May 2020 in which income has decreased compared to the same month last year

The following documents confirming the amount of income for the current and previous year’s corresponding months

(a) Income of the current year (the month in which income decreases): Copies of the book in which income can be confirmed (any form is acceptable).

(b) Income of the previous year (the month in which income is compared): Documents related to the most recent income tax return

(a)Copy of the first table of your income tax return

(b)Copies of two copies of the blue income tax return financial statements or a copy of the book in which income can be confirmed for each month.

*If you don’t have a copy of your tax return, please submit a copy of your tax return that you read on the tax return inspection service of the tax office.

*If it is not possible to submit the tax return, the municipal inhabitant tax return (front and back) is acceptable.

If you are unable to submit the tax return and municipal inhabitant tax return for a reasonable reason, you may submit the Declaration of Decline in Income (Form 3 attached).

However, in such a case, it may take much longer than usual for the incentive payment to be made, or the incentive payment may not be made as a result of the verification, due to the time required for confirmation of the contents.

If the taxpayer’s tax return is replaced by a declaration of decreased income (Form 3 attached to the tax return), the taxpayer is required to submit one of the following documents from a to e in order to confirm the actual condition of the business.

a. Documents that prove that the enterprise has obtained all the necessary permits for its business (e.g. a permit to operate a shelter, a permit to rent out private vehicles for a fee, etc.).

b. A copy of the copy of the notification of opening and closing of a sole proprietorship (with the seal of the tax office) c. Photographs of the exterior and interior of the store etc.

d. Photographs of the website or other documents that show that the company is in business.

e. Copies of transaction documents related to the business (from January 2020)

In the case of a business that has filed a tax return for miscellaneous income or salaried income for the main part of the decrease, please submit a contract of outsourcing services (e.g., delegation contract, quasi-delegation contract, contractor contract, etc.) to a person who is not the applicant’s employer (all pages, regardless of the form). Any style is acceptable). (If the applicant’s signature is not present, it does not matter if the applicant’s signature is not present, as long as the other contractor’s signature is present.

2. If you have been in business for less than one year

(a) The income in April or May 2020 has decreased from the previous months, and the amount of income has been confirmed.

A copy of an acceptable book (any form is acceptable)

Submission of the Declaration of Decline in Income (Attachment Form 3) can be an alternative.

(a) Any one of the following documents (a~e) that can confirm the actual status of the business

a. Copies of documents that show that you have obtained all the necessary permits for your business (e.g., a permit to operate a shelter, a license to rent a car for a fee, etc.)

b. A copy of the copy of the notification of opening and closing of a sole proprietorship (with the seal of the tax office)

c. Photographs of the exterior and interior of the store etc.

d. Photographs of the website or other documents that show that the company is in business.

e. Copies of transaction documents related to the business (from January 2020)

In the case of a business that has filed a tax return for miscellaneous income or salaried income for the main part of the decrease, please submit a contract of outsourcing services (e.g., delegation contract, quasi-delegation contract, contractor contract, etc.) to a person who is not the applicant’s employer (all pages, regardless of the form). Any style is acceptable). (If the applicant’s signature is not present, it does not matter if the applicant’s signature is not present, as long as the other contractor’s signature is present.

3. Copies of Notice of Benefit Determination for Sustainment Benefits

4. Safety Net Guarantee 4 or 5 under Article 2.5 of the SME Credit Insurance Act; or

A copy of the certificate received from the mayor of the municipality regarding the application of the crisis-related guarantee under Article 2, paragraph 6 of the same law.

3 Determination of Payment

The grant will be granted after confirming that the requirements for this grant are met by the application form and other documents. If the application form is complete and there are no deficiencies in the supporting documents, the grant is expected to be paid in about 10 business days after the application is submitted. However, as we expect a large number of applications in the first half of July, we may not receive the incentive payment if there are no deficiencies in the application form or documents to be attached.

Even in the case where the incentive payment is received, the payment may be made in excess of 10 business days.

As a result of receiving and reviewing the application documents, the incentive fee will be disbursed at a later date.

We will send you a notice of non-payment (notice of non-payment decision).

IV. Inquiries about the procedure

Consultations are available for questions and concerns regarding application for the incentive fee as follows Thursday, July 16 – Monday, August 31, 9:00 a.m. to 5:00 p.m. (including Saturdays, Sundays, and holidays) Okinawa Prefectural Incentive Fund for Infectious Diseases Call Center Phone: 098-987-4507

V. Other Notices

(1) The applicant must return the incentive fee to the government and pay a penalty of the same amount as the incentive fee.

(2) In order to ensure the smooth and reliable implementation of the incentive expenditure administration, Okinawa Prefecture will carry out necessary inspections, reports and may require you to take corrective action.

Beware of scams under the name of incentive payments!